Apple ended 2025 in an unusually strong position in the global tablet market, with iPad demand helping drive the category to its best performance since the pandemic era.

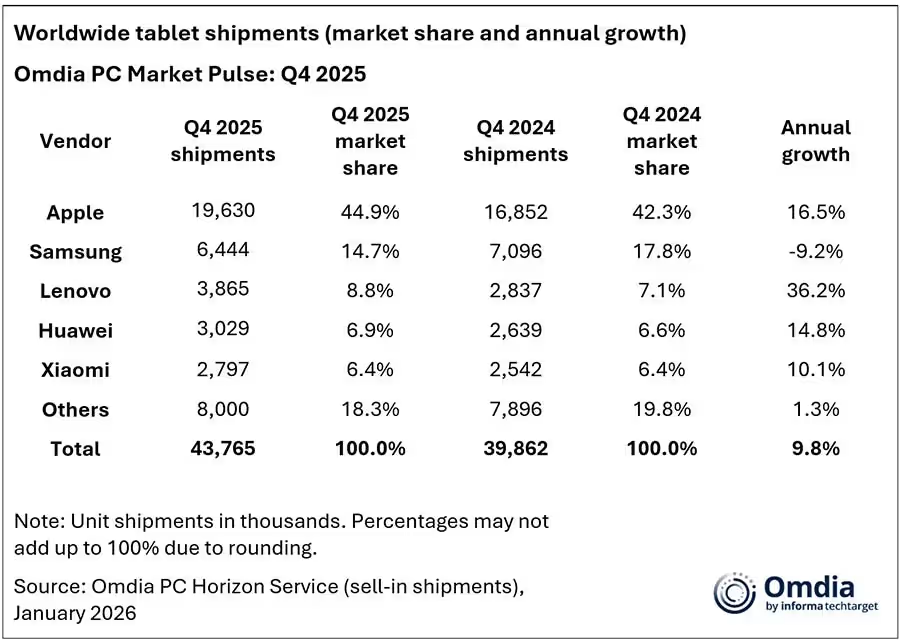

New research from Omdia shows that global tablet shipments reached 162 million units in 2025, representing 9.8% year-over-year growth. The strongest momentum came during the holiday quarter, when shipments hit 44 million units, also up 9.8% compared to Q4 2024.

According to Omdia, this marks the highest annual tablet shipment volume since 2020, aided by renewed consumer interest and concerns around future memory supply constraints.

Apple led the surge in late 2025

Apple was one of the biggest drivers behind that rebound.

In Q4 2025 alone, Apple shipped an estimated 19.6 million iPads, translating to a 16.5% year-over-year increase. Omdia attributes this performance largely to strong demand for the 11th-generation iPad and the M5 iPad Pro, both of which resonated during the holiday season.

That late-year momentum pushed Apple’s tablet market share to 44.9% in Q4, giving the company a commanding lead over the rest of the field:

- Apple: 44.9%

- Samsung: 14.7%

- Lenovo: 8.8%

- Huawei: 6.9%

- Xiaomi: 6.4%

- All others combined: 18.3%

Put simply, nearly one out of every two tablets sold during the holiday quarter was an iPad.

Suggested: Apple’s Best Quarter Ever: iPhone Demand Soars and Active Devices Hit 2.5B

Tablets are shifting toward ecosystems and AI

Omdia’s report also points to a broader change in how tablets are being positioned. Rather than standalone consumption devices, tablets are increasingly marketed as ecosystem-first products, designed to slot into wider hardware and software lineups.

Artificial intelligence is also becoming a bigger part of the story. Vendors are focusing more on AI-driven experiences and cross-platform functionality. Omdia highlights Lenovo’s Qira as an example, operating across Windows and Android to reduce friction between AI assistants and devices.

Apple’s strategy aligns closely with this shift. The firm notes that Apple’s collaboration with Google around Gemini-powered Apple Intelligence features could strengthen the iPad’s role as part of a larger AI-enabled ecosystem spanning phones, tablets, and Macs.

Regional growth was uneven

Tablet demand varied significantly by region in 2025.

- Central and Eastern Europe recorded the fastest growth

- Asia Pacific followed closely behind

- Most regions posted double-digit growth

North America stood out as the exception, where shipments declined overall, with aggressive discounts helping soften the drop during the holiday season.

Even with that regional slowdown, the broader trend is clear. The tablet market is recovering, and Apple is widening the gap. As iPads continue to evolve into productivity tools, creative devices, and AI companions, Apple’s dominance of the category looks firmly intact heading into 2026.