According to new projections from Counterpoint Research, worldwide smartphone shipments are now expected to decline by around 2.1% in 2026, reversing earlier forecasts that predicted modest growth.

The reason is simple: smartphones are getting more expensive to make, and manufacturers are running out of ways to absorb those costs.

Rising Chip and Memory Prices Are Squeezing the Smartphone Industry

Counterpoint Research points to rapidly increasing component costs as the main factor behind the expected market decline. Prices for key parts, especially chips and memory, have climbed sharply throughout 2025 and are projected to rise even further in 2026.

Low-end smartphones are expected to be impacted the most. Counterpoint estimates that the cost of entry-level devices has already increased 20–30% since early 2025, with memory prices potentially rising another 40% through the first half of 2026.

As a result, the total bill of materials for a new smartphone in 2026 could be 8% to over 15% higher than current levels. Those increases are difficult to offset, particularly for manufacturers that rely on thin margins.

AI Demand is Driving the Memory Shortage

The surge in memory and chip pricing is being driven by AI, not smartphones. Chipmakers are prioritizing advanced memory for AI servers and data centers, where demand and profitability are significantly higher than in the mobile market.

This shift has created supply constraints for basic DRAM used in smartphones, and Counterpoint expects these shortages to continue well into 2026. As long as AI infrastructure remains the top priority for suppliers, smartphone manufacturers will continue to feel the pressure.

Smartphone Prices are Likely to Increase in 2026

With production costs rising, Counterpoint expects smartphone brands to pass at least part of the burden onto consumers. Average selling prices are projected to increase by 6.9% globally in 2026.

Some manufacturers may attempt to soften the impact by cutting costs elsewhere, such as shipping phones with less memory, downgraded cameras, or fewer premium features. Others may push buyers toward higher-priced models where margins are easier to protect.

Either way, truly affordable smartphones are likely to become harder to find.

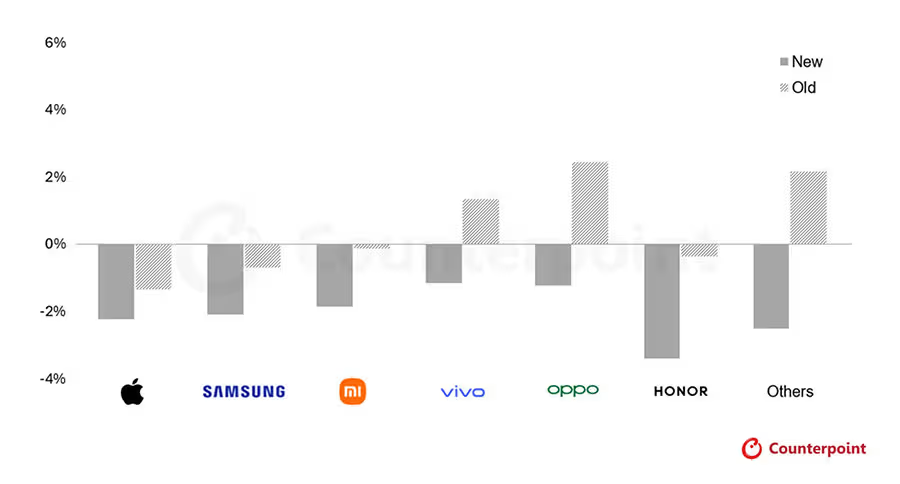

Apple and Samsung are Best Positioned to Weather the Slowdown

While the entire market is expected to shrink, Apple and Samsung are seen as the most resilient players. Counterpoint estimates that both companies could see shipment declines of around 2%, roughly in line with the overall market contraction.

Brands with less pricing flexibility, particularly Chinese manufacturers like Honor, Oppo, and Vivo, face greater risk. Honor could see shipments fall by more than 3%, while Oppo and Vivo, previously expected to grow in 2026, are now forecast to decline.

Apple’s position is especially strong. Its scale, supply chain leverage, and cash reserves give it the ability to absorb higher DRAM costs in the short term without immediately raising retail prices. Analysts expect Apple to manage margin pressure internally before making significant pricing changes.

What this Means for Smartphone Buyers

For consumers, the outlook suggests fewer bargains and slower hardware progress, especially in the budget and midrange segments. Phones may become more expensive while offering fewer noticeable upgrades year over year.

This also helps explain why recent smartphone releases feel increasingly iterative. When manufacturers are spending more just to maintain existing specs, there is less room for meaningful innovation outside of high-end flagships.

The Smartphone Market is Entering a Tougher Phase

A shrinking smartphone market in 2026 does not signal the end of mobile growth, but it does mark a shift. Rising component costs, AI-driven supply constraints, and tightening margins are reshaping how phones are built, priced, and sold.

Apple and Samsung are likely to navigate this transition with minimal disruption. Smaller and cost-focused brands will have a harder time. And for buyers, smartphones may quietly become more expensive with fewer headline-grabbing improvements.

The era of cheap upgrades may be coming to an end.