Google’s Pixel phones remain a niche player in the global smartphone market, but their momentum continues to build. According to new data from Counterpoint Research, Pixel shipments grew 25% year over year in 2025, marking another strong growth phase for Google’s hardware business.

That growth is notable because Pixel still accounts for a relatively small share of global shipments, especially outside markets like North America and Japan, where the brand has a stronger foothold. Pixel, along with Nothing, remains grouped under the industry’s “Others” category, which actually shrunk overall in 2025 despite their individual gains.

Nothing, meanwhile, recorded an even faster 31% year-over-year growth, continuing its trajectory as one of the few emerging brands showing consistent momentum.

Apple Leads the Global Market

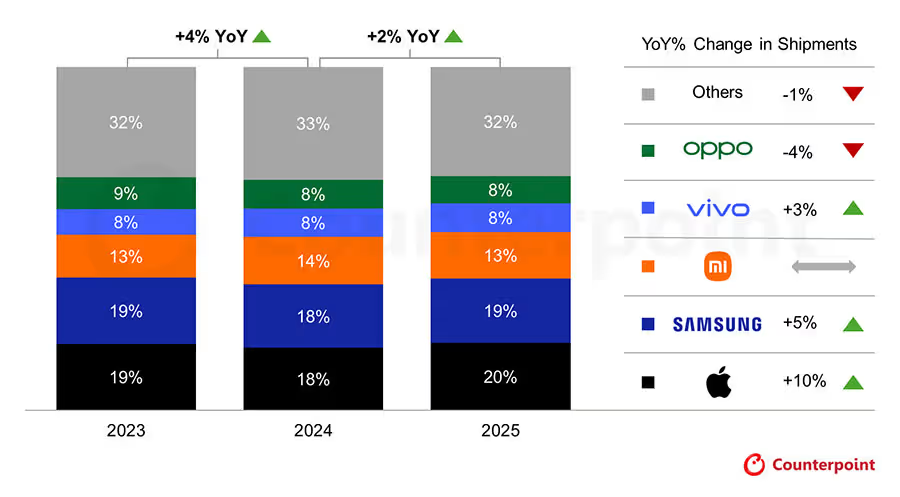

While Pixel posted impressive growth, Apple emerged as the world’s largest smartphone brand in 2025, overtaking Samsung by a narrow margin.

Key highlights from the report:

- Apple:

- 10% year-over-year growth

- 20% global market share

- Strong Q4 driven by the iPhone 17 series

- Continued momentum in Japan, India, and Southeast Asia

- Samsung:

- 19% market share, placing second globally

- Xiaomi:

- Flat year-over-year growth, holding third place

- Vivo:

- 3% growth, ranking fourth

- Oppo:

- 4% decline, rounding out the top five

Counterpoint notes that Apple’s performance is particularly notable in regions traditionally dominated by Android devices, signaling continued premium-market strength.

2026 Outlook: a Softer Market Ahead

Looking ahead, Counterpoint warns that 2026 may be more challenging for the smartphone industry. Rising component costs, along with DRAM and NAND shortages, are expected to constrain shipments.

As Counterpoint’s Tarun Pathak explains:

“The global smartphone market is set to soften in 2026 amid DRAM/NAND shortages and rising component costs… Apple and Samsung are likely to remain resilient, supported by stronger supply chain capabilities and premium market positioning.”

In contrast, Chinese manufacturers focused on lower-price segments are expected to face the most pressure.

The takeaway: while Google Pixel’s growth remains impressive, the broader market is tightening, and scale, pricing power, and supply chain control will matter more than ever in the year ahead.