Apple has pulled ahead of Samsung in global smartphone market share, marking a shift after years of tight competition between the two rivals.

New market intelligence data from Counterpoint Research shows Apple finishing 2025 as the world’s top smartphone brand by share, and the story goes beyond just the iPhone 17.

Apple Takes the Lead After Years

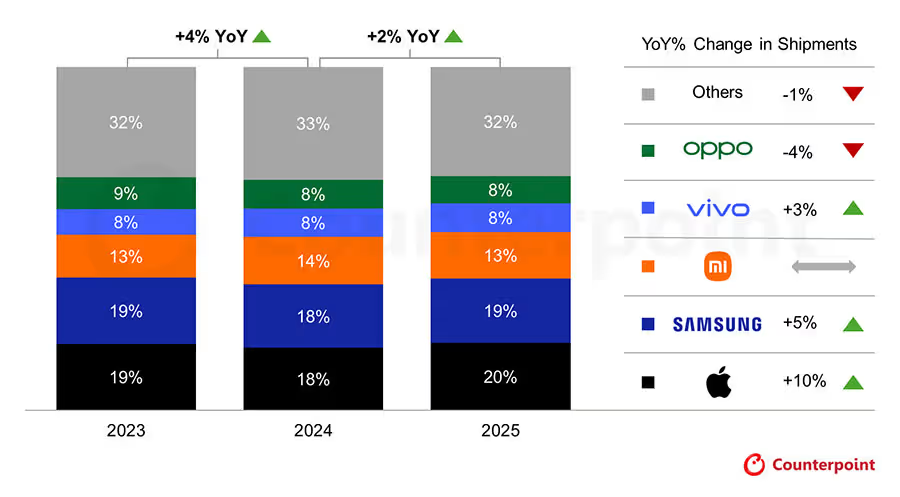

For the past two years, Apple and Samsung have been trading places at the top. In 2023, both companies held roughly 19 percent of the global smartphone market. That balance remained largely unchanged through 2024, even as Chinese brands gained ground and squeezed overall share.

By the end of 2025, Apple had clearly moved ahead. The iPhone now accounts for around 20 percent of global smartphone shipments, while Samsung trails slightly behind. More importantly, Apple posted the strongest year-over-year growth among the top five brands, with shipments up roughly 10 percent.

It Was Not Just the iPhone 17

The iPhone 17 lineup played a major role in Apple’s late-year momentum, especially during the fourth quarter. However, analysts say Apple’s lead cannot be credited to a single launch cycle.

Older models continued to sell well in key regions. The iPhone 16 maintained strong demand in Japan, India, and parts of Southeast Asia, helping Apple build volume across both premium and mid-range segments. This dual-generation strength gave Apple a broader sales base than Samsung, which has relied more heavily on newer flagship launches.

Related: iPhone 17 Lineup Drives Smartphone Growth in China During Singles Day

Upgrade Cycles are Working in Apple’s Favor

Another factor is timing. Many users who bought phones during the pandemic are now upgrading, and Apple appears to be capturing a disproportionate share of those replacements. For long-time iPhone users, the jump from older hardware to newer models has been large enough to justify an upgrade.

This replacement wave has given Apple steady momentum rather than a single spike, which helps explain why its growth outpaced Samsung’s over the year.

Emerging Markets are Doing More of the Work

Apple’s growth is no longer limited to North America and Western Europe. Expanding retail presence, financing options, and a stronger product mix have helped Apple gain traction in emerging and mid-sized markets.

These regions were once considered Samsung’s stronghold, but Apple’s improved availability and longer software support are making the iPhone a more attractive long-term purchase for new buyers.

What Comes Next for Apple and Samsung

Looking ahead, rising memory and component costs could slow the overall smartphone market. Even so, both Apple and Samsung are expected to weather the pressure better than smaller competitors.

Related: Apple Leans More on Samsung as iPhone RAM Prices Surge

Samsung benefits from manufacturing its own memory components, while Apple uses its scale to lock in pricing and secure supply well in advance. That advantage could keep both companies stable even if total shipments soften in 2026.

For now, though, the headline is clear. Apple has regained the top spot in global smartphone market share, and it did so through consistent demand across multiple iPhone generations, not just one successful launch.