Apple ended 2025 on a high note in China. After spending much of the year trailing domestic rivals, the company staged a strong comeback in the fourth quarter as demand for the iPhone 17 lineup accelerated during the holiday season.

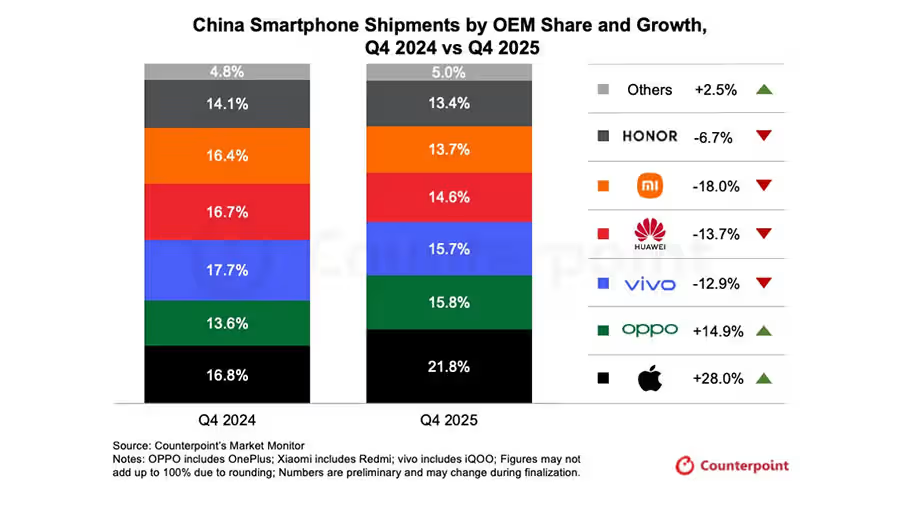

New data from Counterpoint Research shows Apple finishing Q4 2025 as the leading smartphone brand in China, outperforming a market that continued to contract under rising costs and weaker consumer demand.

China’s smartphone market shrank, but Apple moved in the opposite direction

The broader market context makes Apple’s performance even more notable. Smartphone shipments in China declined 1.6% year over year in Q4 2025 and ended the full year down 0.6%, largely due to higher prices linked to memory chip shortages.

Apple, however, bucked the trend.

- Apple’s China shipments rose 28% year over year in Q4

- The company captured 22% market share, ranking first for the quarter

- Several competitors struggled with supply constraints and limited inventory

While the market cooled, Apple found momentum at exactly the right time.

Strong iPhone 17 sales powered Apple’s Q4 comeback

According to Counterpoint, the iPhone 17 lineup accounted for around 20% of Apple’s total China shipments during the quarter. Demand was especially strong for the higher end models, reinforcing Apple’s premium positioning in the region.

A few factors helped drive that success:

- Strong interest in iPhone 17 Pro models

- Improved product availability late in the year

- Faster supply ramp up compared to rivals facing component shortages

Apple’s ability to meet holiday demand proved critical as competitors struggled to keep shelves stocked.

Why the iPhone Air failed to gain traction in China

One model did not share in the broader success. The iPhone Air captured only a low single digit share of Apple’s China shipments following its debut.

Counterpoint points to several reasons:

- A later launch timeline in China compared to other regions

- Perceived compromises tied to the phone’s ultra thin design

- A feature set that appeared less competitive next to Pro models

The data suggests Chinese buyers remain cautious about design focused trade offs, especially at premium price points.

Related: iPhone 17 vs iPhone Air: The $200 Difference That Actually Matters

Apple narrowed the gap with Chinese brands across 2025

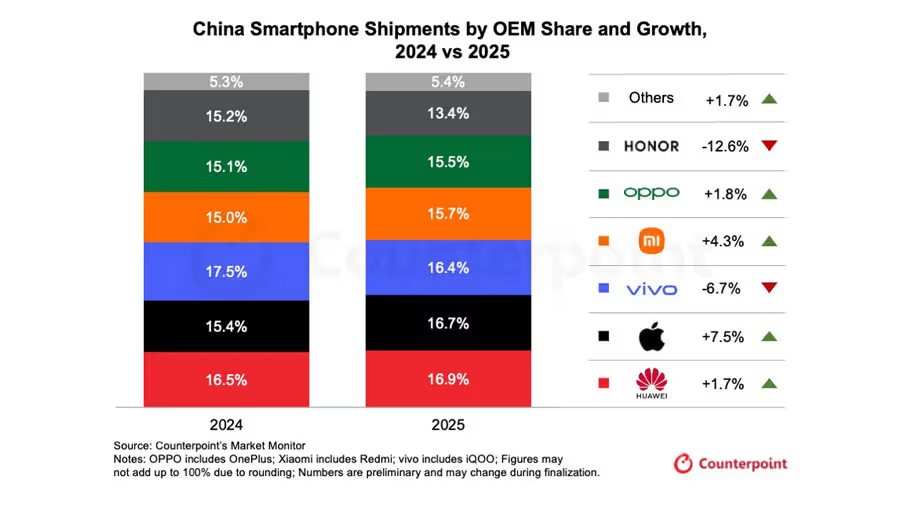

Although Apple did not lead China’s smartphone market for the full year, it closed the gap significantly by year end.

Full year 2025 China market share breakdown:

- Huawei: 16.4%

- Apple: around 16%

- vivo: around 16%

- Xiaomi: around 15%

- Oppo: around 15%

Apple’s late year surge positions the company more competitively heading into 2026.

Apple remained the world’s largest smartphone vendor in 2025

On a global level, Apple’s leadership remained intact. A report by Counterpoint last week showed worldwide smartphone shipments increasing by 2% YoY in 2025.

Apple’s global share showed 10% YoY growth, reinforcing its position at the top despite ongoing market volatility.

What Apple’s China rebound signals going forward

Apple’s Q4 turnaround in China highlights how critical timing, supply execution, and flagship demand remain in a slowing market. The strong performance of the iPhone 17 lineup shows that Apple can still outperform local competitors when conditions align.

At the same time, the muted response to the iPhone Air offers a clear signal. Design alone is not enough in markets where buyers closely weigh features against price.

As 2026 approaches, Apple enters the year with renewed momentum in one of its most challenging regions.