Apple’s latest earnings report is in, and honestly, it’s the kind of quarter most companies can only dream about.

We’re talking record-breaking revenue, iPhone sales that hit historic highs, and an ecosystem so massive that 2.5 billion Apple devices are now actively being used worldwide.

Let’s break down what happened, why it matters, and what it could mean for the rest of 2026.

Apple posts its best quarter of all time

Apple’s Q1 2026 earnings weren’t just good, they were record-setting.

The company reported:

- $143.8 billion in revenue

- $42 billion in profit

- 16% growth year-over-year

Wall Street expected strong numbers, but Apple still managed to beat forecasts comfortably.

This is now officially Apple’s biggest quarter ever, topping even last year’s record.

iPhone sales were absolutely staggering

The real headline here is the iPhone. Apple pulled in an unbelievable:$85 billion from iPhone sales alone. That’s the best iPhone quarter in history, smashing the previous record of $71.6 billion back in 2022.

Related: Apple Dominates 2025 Rankings, Base iPhone 17 Shines

Tim Cook called demand “unprecedented,” and said Apple saw major growth from people switching over from other platforms.

In other words: the iPhone is still the main character.

The Mac slowed down, but the user base keeps growing

Mac revenue dipped slightly:

- $8.3 billion (down 7%)

But Apple isn’t sounding worried.

Cook pointed out something more important: the Mac has its largest installed base ever, and nearly half of Mac buyers last quarter were new switchers coming from Windows.

So even in a slower hardware cycle, the Mac ecosystem keeps expanding.

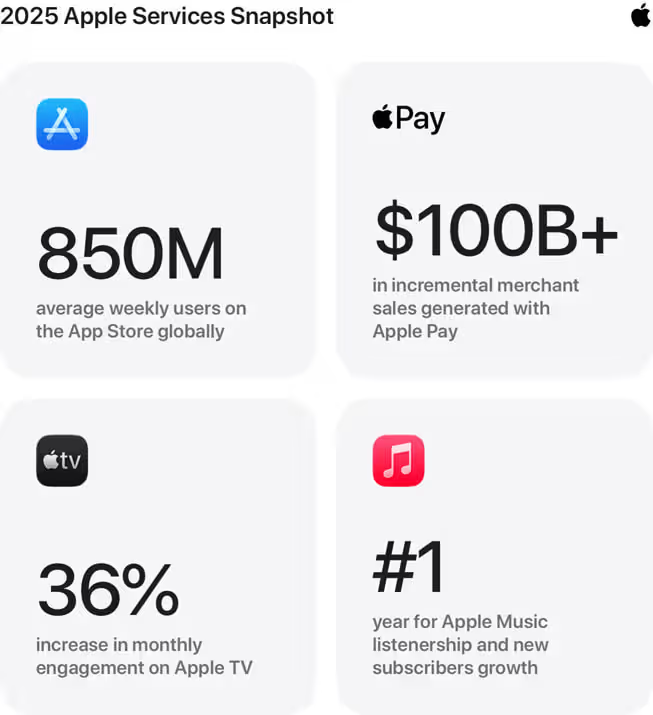

Services are quietly becoming Apple’s second empire

Apple’s Services business continues to be a powerhouse:

- $30 billion in revenue

- 15% growth year-over-year

That includes Apple Music, iCloud, App Store spending, and Apple TV+.

Cook even highlighted that Apple TV viewership jumped 36% in December, showing real momentum in streaming.

In fact, analyst Ming-Chi Kuo suggests Apple’s booming Services business could help offset rising memory costs for hardware like the iPhone and iPad. Macs, however, may be a more likely target for price increases.

The takeaway is simple: Apple isn’t just selling devices anymore. It’s selling what comes after the device.

Apple now has 2.5 billion active devices worldwide

Alongside earnings, Apple revealed (via CNBC) one of its most jaw-dropping stats: 2.5 billion active Apple devices are currently in use around the world.

That includes iPhones, iPads, Macs, Watches, AirPods, and more.

For context:

- January 2025: 2.35 billion devices

- January 2026: 2.5 billion devices

That’s another 150 million new active devices in just one year, again.

This number matters because every device is a potential Services customer, which is exactly where Apple’s growth is heading.

What this means for 2026

Apple’s quarter paints a clear picture:

- iPhone demand is still massive

- The ecosystem keeps pulling in switchers

- Services revenue is becoming more critical than ever

- The active install base is reaching unimaginable scale

Apple also hinted that supply chain pressures (including rising RAM costs across the industry) could become more noticeable going forward, but for now, Apple is still growing at full speed.

And with a crowded hardware roadmap for 2026, that 2.5 billion device number might not stay put for long.

Quick revenue breakdown (Q1 2026)

Here’s how Apple’s categories performed:

- iPhone: $85B (up from $69B)

- iPad: $8.6B (up from $8B)

- Mac: $8.3B (down from $8.9B)

- Wearables/Home: $11.5B (slightly down)

- Services: $30B (up from $26B)