YouTube superstar MrBeast is making a bold move into the financial world. His company, Beast Industries, has officially acquired Step, a teen-focused banking app, to launch a new initiative called MrBeast Financial.

The acquisition signals a growing trend of creators entering the fintech space, combining audience reach with financial technology to create unique money management experiences.

Step: Banking for the next generation

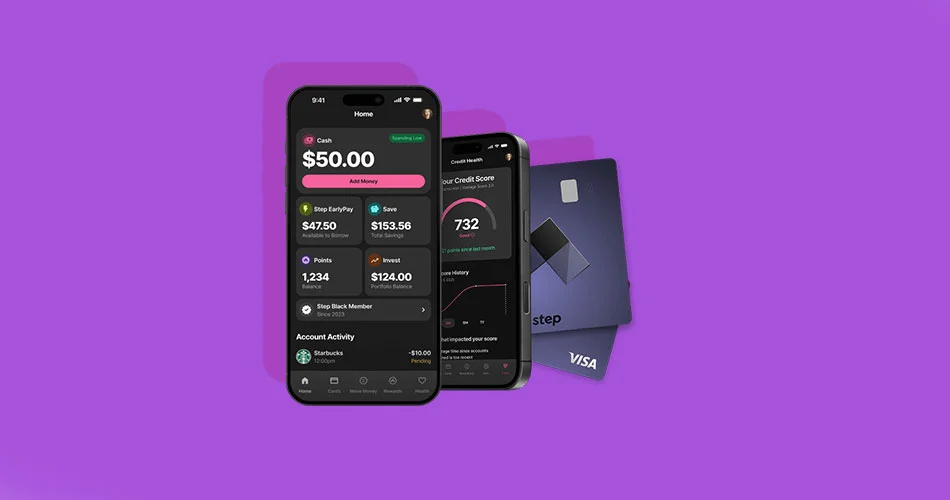

Step is designed to help young people learn the basics of financial literacy while managing their money safely. Key features of the app include:

- Building and monitoring credit to establish a strong financial foundation

- Interest-free loans of up to $250 for emergencies or short-term needs

- Interactive challenges and games that teach smart money habits

- Cash rewards for completing financial tasks and activities

With nearly 80,000 reviews on the App Store and a 4.7-star rating, Step has already proven popular with its target audience. Teen users appreciate the app’s simple, engaging interface and the ability to start learning about money management early.

What MrBeast financial aims to do

By combining Step’s technology platform with Beast Industries’ massive following, MrBeast aims to:

- Make financial wellness accessible to millions of young people

- Offer educational tools that teach practical money skills

- Integrate philanthropic initiatives into everyday financial learning

- Provide a safe and gamified banking experience for teens

MrBeast has a history of using his platform to innovate in entertainment and philanthropy, and now he’s applying that approach to fintech. The acquisition represents a significant milestone, bridging creator influence with financial technology.

How to get step

Step is available to download on the App Store and Goole Play. This move could rapidly increase the app’s popularity as MrBeast promotes it across YouTube, social media, and other platforms.

With this acquisition, MrBeast is set to redefine how young audiences interact with money, combining education, entertainment, and accessibility into one platform.